How is the data sourced?

Our data is gathered from publicly available sources, which range from public websites to reports received via Freedom of Information Act requests as well as individual GPs. We reach out to hundreds of GPs, public pensions, endowments and other institutional investors to provide fund information and ongoing performance activity.

When making determinations on the LP data we publish, we factor in the trustworthiness of a source’s reported information as well as that source’s ability to deliver updated, reliable information on a regular basis. We also publish fund performance data directly from the GPs to stand alongside LP data if available. By default, we show the LP data first if we have data from both.

If you have any questions on the data published or are interested in providing data to PEI, please do not hesitate to contact the research team at: researchandanalytics@pei.group

Key performance metrics definitions

Commitment

Commitments are the total investment amount pledged to a fund by the limited partner that the fund manager/general partner may call upon and drawdown over a specified period, typically within the first five years.

Contribution

Contributions, also known as paid-in, are the net capital calls made by the limited partner and requested by the fund manager to invest in a fund.

Distribution

Distributions are the net capital returned or passive income generated by the fund. Components of distributions typically include capital gains, dividend income and interest income.

Remaining value

Remaining value is the estimated, total unrealized value of the fund’s outstanding investments. Remaining value is closely associated with a fund’s net asset value (NAV).

Percent called

Percent called represents the calculation of total contributions divided by the total commitment. The ratio is indicative of a funds’ dry powder or how much cash that has been promised to the fund manager remains uncalled.

| Fund name | Quarter | Called | DPI | RVPI | TVPI | IRR | Commitment | Called amount | Distributed | Remaining value |

|---|---|---|---|---|---|---|---|---|---|---|

| Sample Fund I | Q4 2022 | 72.9% | 0.67x | 0.83x | 1.50x | 13.21% | $25.00m | $18.23m | $12.25m | $15.15m |

| Sample Fund I | Q3 2022 | 71.1% | 0.59x | 0.84x | 1.43x | 10.77% | $25.00m | $17.78m | $12.25m | $14.88m |

| Sample Fund I | Q2 2022 | 62.0% | 0.68x | 0.28x | 0.95x | -2.24% | $25.00m | $15.50m | $10.50m | $4.35m |

| Sample Fund I | Q1 2022 | 62.0% | 0.58x | 0.29x | 0.87x | -5.56% | $25.00m | $15.50m | $9.00m | $4.50m |

Percent called = (Called amount/Commitment) x 100

Distributions to paid-in (DPI)

DPI is the calculation of realized cumulative distributions paid to the limited partner from the fund manager over cumulative contributions.

| Fund name | Quarter | Called | DPI | RVPI | TVPI | IRR | Commitment | Called amount | Distributed | Remaining value |

|---|---|---|---|---|---|---|---|---|---|---|

| Sample Fund I | Q4 2022 | 72.9% | 0.67x | 0.83x | 0.83x | 13.21% | $25.00m | $18.23m | $12.25m | $15.15m |

| Sample Fund I | Q3 2022 | 71.1% | 0.59x | 0.84x | 0.84x | 10.77% | $25.00m | $17.78m | $10.50m | $14.88m |

| Sample Fund I | Q2 2022 | 62.0% | 0.68x | 0.28x | 0.28x | -2.24% | $25.00m | $15.50m | $10.50m | $4.35m |

| Sample Fund I | Q1 2022 | 62.0% | 0.58x | 0.29x | 0.29x | -5.56% | $25.00m | $15.50m | $9.00m | $4.50m |

DPI = Distributions / Called Amount

Remaining value to paid-in (RVPI)

RVPI represents the calculation of a fund’s remaining value which has not yet been realized over cumulative contributions invested.

| Fund name | Quarter | Called | DPI | RVPI | TVPI | IRR | Commitment | Called amount | Distributed | Remaining value |

|---|---|---|---|---|---|---|---|---|---|---|

| Sample Fund I | Q4 2022 | 72.9% | 0.67x | 0.83x | 1.50x | 13.21% | $25.00m | $18.23m | $12.25m | $15.15m |

| Sample Fund I | Q3 2022 | 71.1% | 0.59x | 0.84x | 1.43x | 10.77% | $25.00m | $17.78m | $10.50m | $14.88m |

| Sample Fund I | Q2 2022 | 62.0% | 0.68x | 0.28x | 0.95x | -2.24% | $25.00m | $15.50m | $10.50m | $4.35m |

| Sample Fund I | Q1 2022 | 62.0% | 0.58x | 0.29x | 0.87x | -5.56% | $25.00m | $15.50m | $9.00m | $4.50m |

RVPI = Remaining Value / Called Amount

Total value to paid-in (TVPI)

TVPI is the calculation of remaining value plus cumulative distributions received (total value) over cumulative contributions.

| Fund name | Quarter | Called | DPI | RVPI | TVPI | IRR | Commitment | Called amount | Distributed | Remaining value |

|---|---|---|---|---|---|---|---|---|---|---|

| Sample Fund I | Q4 2022 | 72.9% | 0.67x | 0.83x | 1.50x | 13.21% | $25.00m | $18.23m | $12.25m | $15.15m |

| Sample Fund I | Q3 2022 | 71.1% | 0.59x | 0.84x | 1.43x | 10.77% | $25.00m | $17.76m | $10.50m | $14.88m |

| Sample Fund I | Q2 2022 | 62.0% | 0.68x | 0.28x | 0.95x | -2.24% | $25.00m | $15.50m | $10.50m | $4.35m |

| Sample Fund I | Q1 2022 | 62.0% | 0.58x | 0.29x | 0.87x | -5.56% | $25.00m | $15.50m | $9.00m | $4.50m |

TVPI = (Distributions + remaining value) / Called amount

Fund size

This is the total amount of money in a fund. The total amount is comprised of variable commitments from multiple limited partners that have contracted to provide the fund manager with an agreed amount of capital over the fund’s lifespan.

Net internal rate of return (IRR)

Net IRR is calculation that provides an annualized compounded rate of return. A rate of return is formulated by calculating the current net cashflows and then discounting the net present value of the investment to equal zero. This discount rate is the estimated, annualized return of the investment. Cashflows should be the net amount after management fees.

Note: We only publish net IRR values provided by our source documents. We do not provide any internally created IRR calculations for individual funds.

Vintage year

Primarily, the vintage year denotes the year in which capital is first called by the fund. If such information is unavailable, public sources are used to inform vintage year. In such cases vintage year may also be based on when a fund was formed or when it has its final close.

Fund performance tabular data

Our data is presented in table format under the ‘Fund Performance’ tab. Here, a user can view how a fund’s performance has evolved quarterly over time. We present all available data as submitted by the limited or general partner. If an LP or GP does not provide IRR or another attribute for a given fund in their reports, then we will leave blank any field that incorporates unprovided attributes. Performance matrices are based on commitment size for LP sourced data and fund size for GP sourced data.

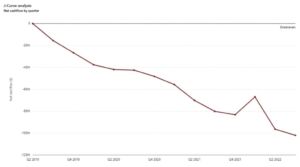

J-Curve

A reference to the unique shape of plotted net cashflows (cumulative contributions minus cumulative distributions) of private funds. The plotted graph has a distinct J-curve shape when looking at the entire lifecycle of a fund. The fund typically begins with negative cashflows as initial capital is drawn and then converts into positive cashflows in subsequent years as the fund matures, ideally creating a steep rise in the cashflow trajectory. Graphical J-curve representations of fund performance can be found in the ‘J-Curve’ analysis tab of individual fund pages. Performance matrices are based on commitment size for LP sourced data and fund size for GP sourced data.

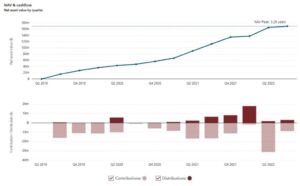

NAV & Cashflow

The ‘NAV & Cashflow’ tab comprises two graphs. The NAV graph is a line graph representing the NAV level of the fund by quarter. This is complemented by the cashflow graph below. This interactive bar graph allows the user to see when and how much money is being called (contributions) and when and how much money is being returned (distributions). The user can select and deselect contributions and distributions as needed. Performance matrices are based on commitment size for LP sourced data and fund size for GP sourced data.

Why don’t all funds show complete performance data?

Our fund data is compiled from a wide array of sources that document their fund performance metrics in a variety of slightly dissimilar ways. Some sources fail to provide underlying cashflow information, which would allow us to calculate all performance metrics.

It is also common for many of our sources to not calculate a net IRR value for a given fund until its third year. This is due to IRR values being rather volatile and misleading in their first few years.

If a data source has not provided sufficient historical data point, we will not be able to plot a chart.

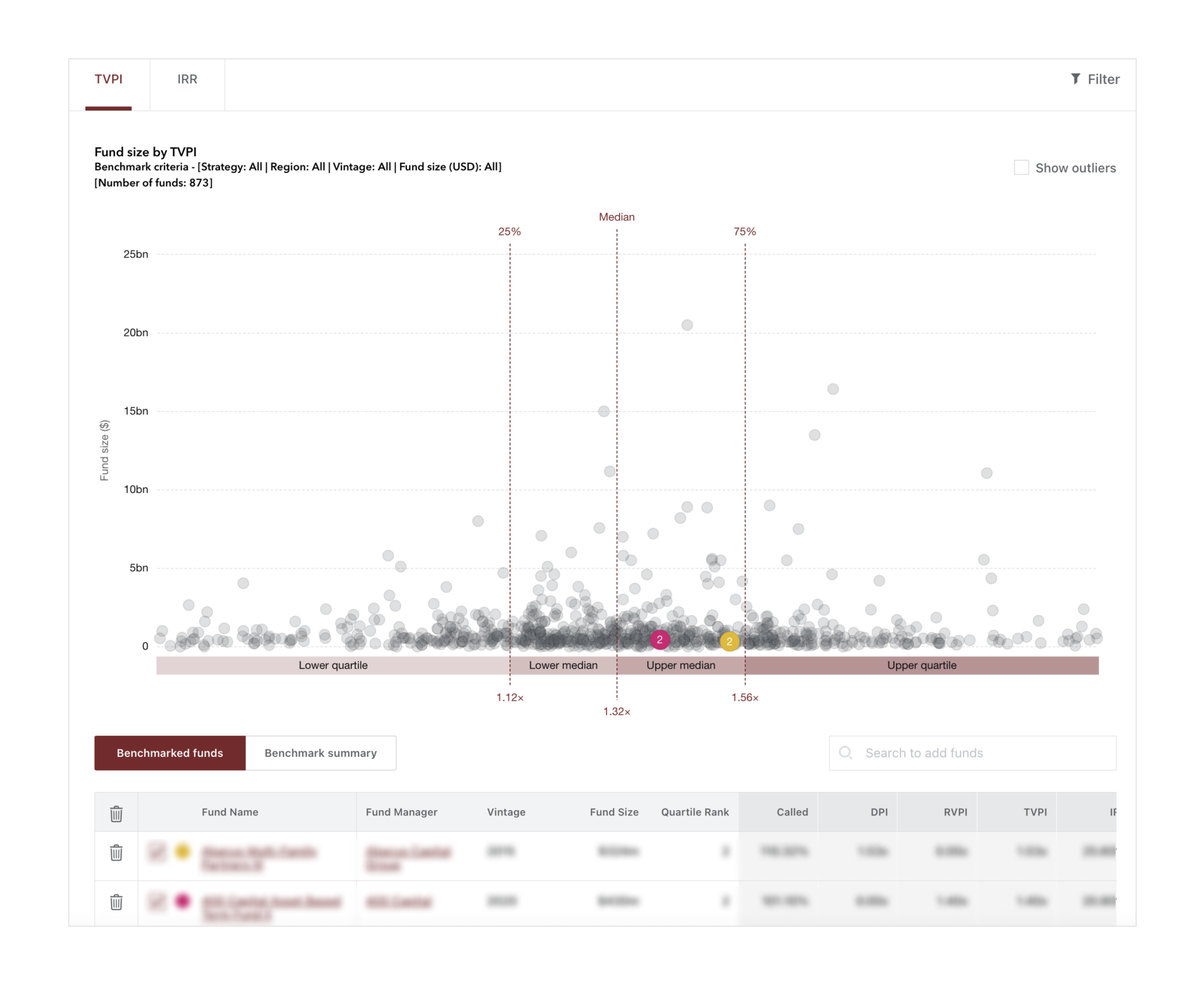

Benchmarks & Quartile ranking

In the Benchmarks section, users can assess a fund’s performance relative to other funds. Users can customize their benchmarking criteria based on their own research needs. One can filter by region, investment strategy, fund size and vintages up to five years around a selected vintage to create a unique benchmark plot graph.

All funds in a cohort are sorted into quartiles based on their most recent available TVPI or IRR performance data which the user can toggle between. PEI employs the IQR (Inter Quartile Range) method to account for and remove any outliers in our dataset when determining quartiles. Subscribers can select LPs as the only data source or include GPs to expand the data set.

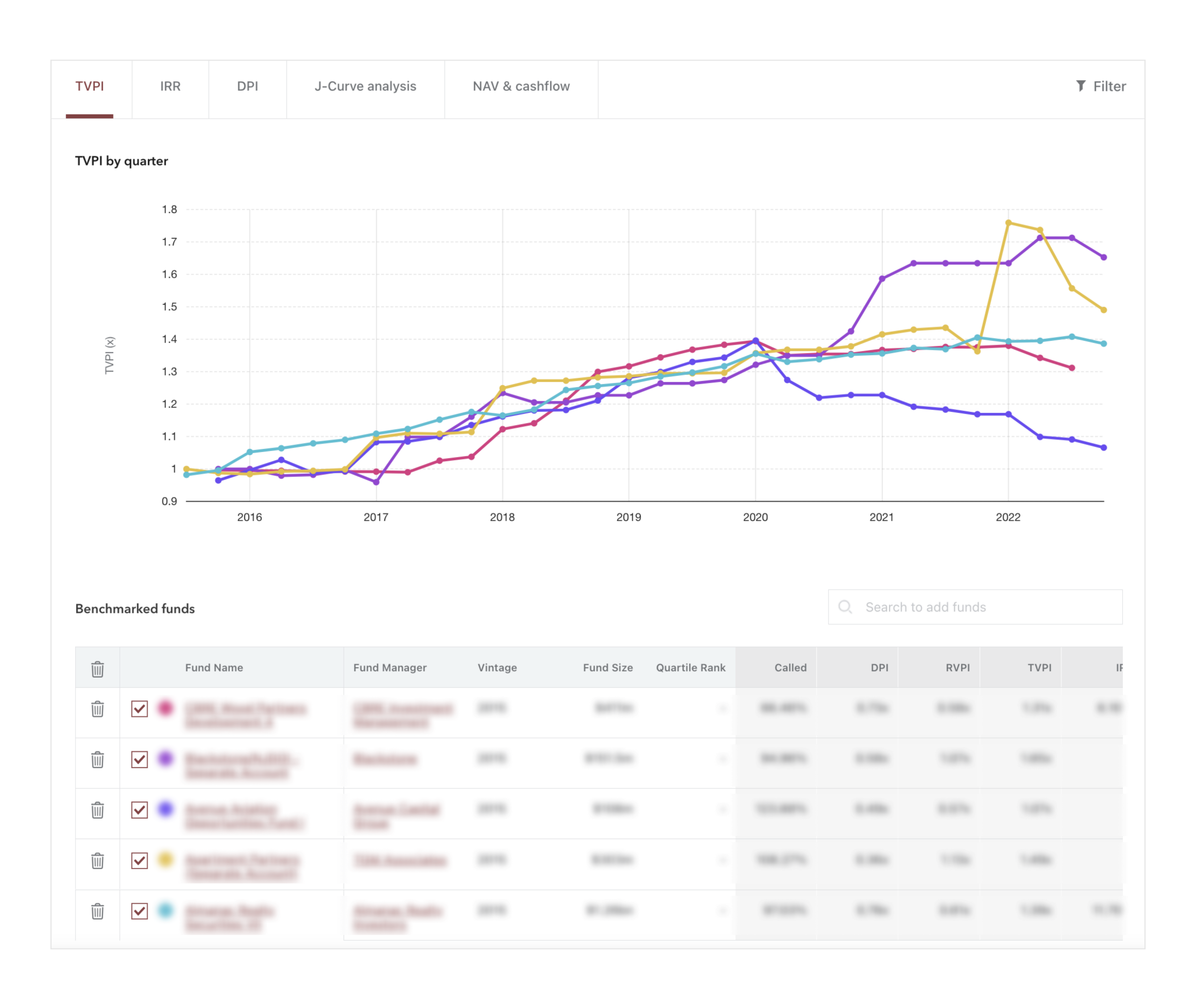

In the Fund compare section, users can plot the performance of up to five funds of their choosing.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email:

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: